The Best 12 Fundamentals & Financial Data Platforms

Discover & compare some of the best fundamentals financial data platforms that suit your needs.

There are a number of platforms to choose from, each having their own set of unique levers, advantages and limitations.

We have analyzed a number of platforms in detail taking into account various features, advantages and limitations of the platforms, as well as pricing.

The below list represents a solid pool of platforms the individual, boutique, family office and professional investors can choose from.

1. αlphaFinn – best for fundamentals benchmarking & insights, not just plain data

Summary: αlphaFinn offers a holistic view of financial fundamental data and macroeconomic indicators. It offers professional level insights such as benchmarking of individual stocks, sectors, broader indices and more. AlphaFinn also offers a customizable benchmark that investors can build themselves from the covered +5,000 stock universe.

It started of as a platform for professional investors, boutiques and family offices, now offering benchmarking insights, which no other platform offers, to retail investors.

Key Features:

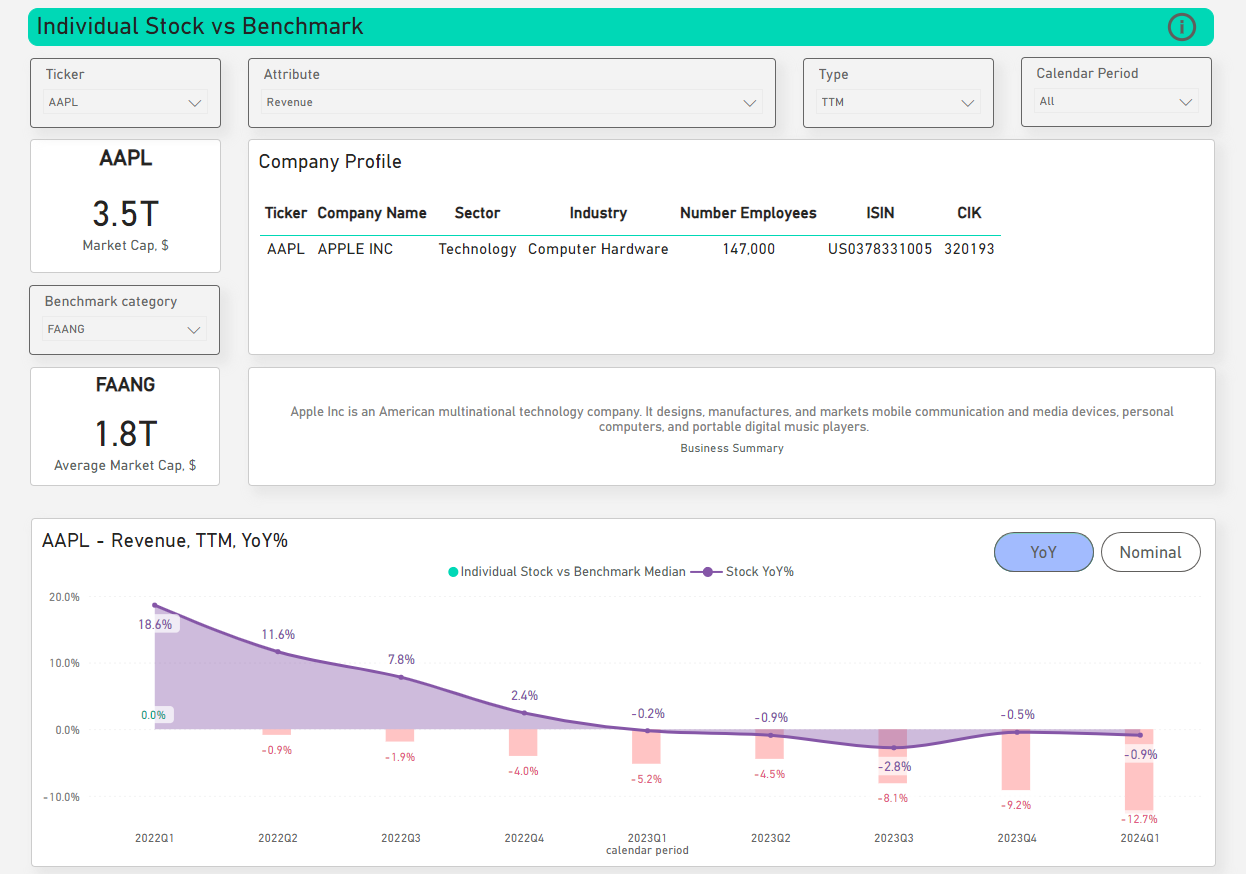

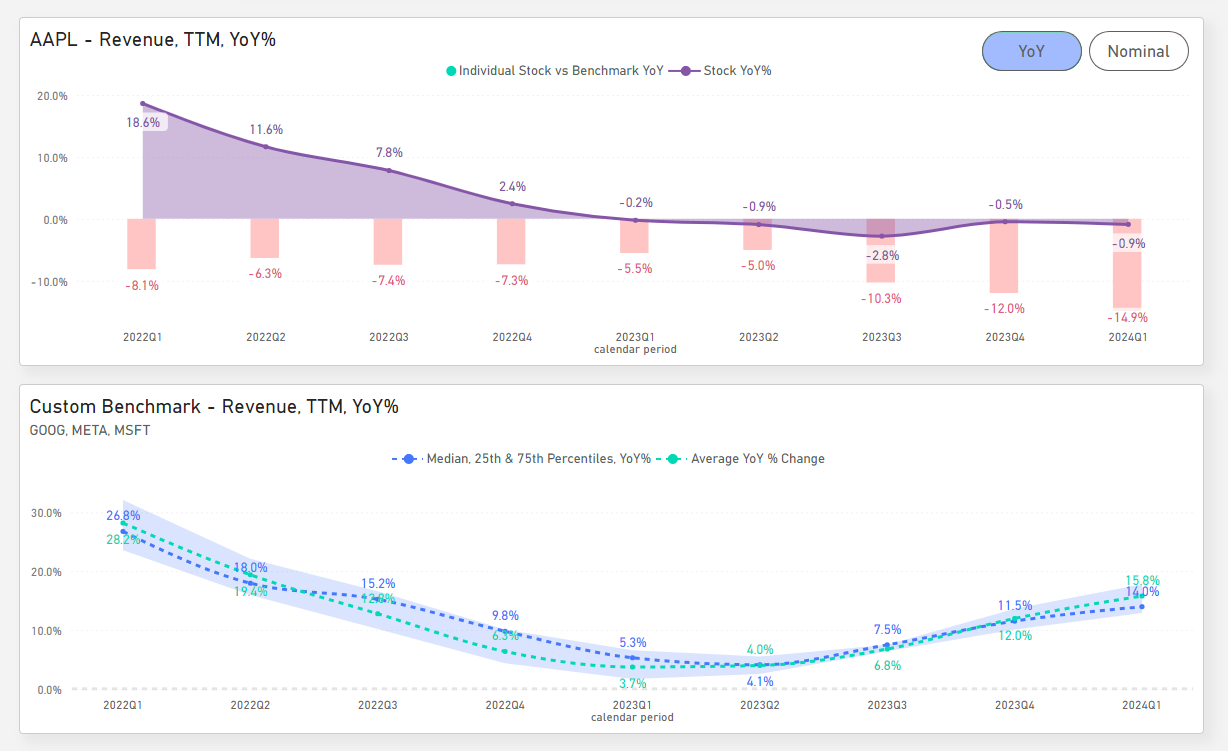

Benchmarking

This unique feature allows the user to compare a stock of choice against a broader benchmark (whether it’s S&P500, other indices, sectors, or a custom made benchmark) with the option to look at hundreds of metrics (growth, margins, ratios, etc.). With clear visuals the investor can identify in seconds whether the stock is over or underperforming against the benchmark of choice.

Data Visualization

AlphaFinn offers its users clear, informative and simple visuals that enables investors to identify how the stock is performing in a matter of seconds given their selected choice of parameters.

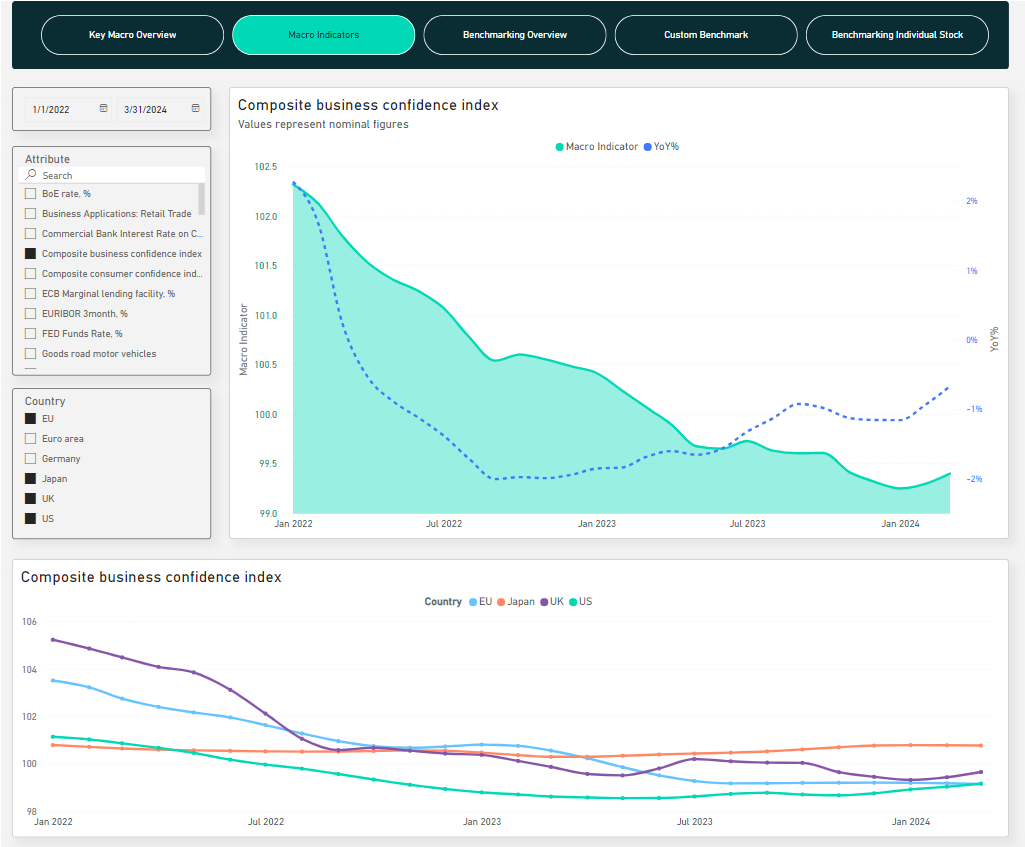

Macroeconomic indicators

AlphaFinn is one of the very few platforms that offers both fundamentals and macroeconomic data. Having a combination of such data gives an advantage to the investor, which can uncover broader trends, relationships and insights by overlaying and comparing financial and macro data.

Pros:

- Company Benchmarking (not offered by any other platform)

- Combination of Fundamentals & Macroeconomic Data

- +10 Years of Historical Data

- Offers 7 Day Free Trial

- Intuitive, Easy to Use Interface & Visuals

- Ability to Export Data To Excel or PDF

- Premium plans start at $13.5 a month

Cons:

- No mobile app (in the Roadmap and will be introduced in the near future!)

- Limited use case for day traders

Who is it best for?

Started off as a platform for professional investors such as boutiques and family offices, now offering all of these insights to retail investors as well.

2. YCharts

Summary: YCharts is a comprehensive and versatile financial data platform, offering a wide range of tools for stock and fund research, economic data analysis, and market insights. It has plans for individual investors, professional advisors, and large firms.

Pros:

- Various financial data and research tools

- Customizable dashboards and reports

- Index and mutual fund data

Cons:

- No public pricing

- Targeted more towards professionals, enterprise level pricing

- Steep learning curve

Who is it best for?

YCharts is targeted more towards professional investors. The platform is not as intuitive and does require some time to learn how to use it, although it can be used by individual investors as well.

3. Koyfin– closest alternative to Bloomberg for retail investors

Summary: Koyfin provides a range of tools for investors, such as advanced graphing, market dashboards, and various features for portfolio management and stock research.

Pros:

- Numerous pricing related data points (FX, equities, commodities, etc.)

- Financial news alerts

- Customizable investing dashboards & watchlists

- Offers a free trial

- Paid plans start from $49 a month

Cons:

- Relatively basic fundamentals data

- Benchmarking not available

- Complex UI

Who is it best for?

Retail investors that are looking for various datapoints regarding instrument pricing related data & financial news alerts.

4. Finviz– best free option for basic equities related data

Summary: Finviz is a popular financial platform that offers stock screening and financial visualizations for both investors and traders, including real-time quotes.

Pros:

- Intuitive and easy to use interface

- Customizable screener including fundamental & technical variables

- Charting & technical visualizations

- Very broad stock universe

- Offers free plan. Paid plans start from $24.96 per month

Cons:

- Limited features on the free version

- Very basic fundamentals data

- Premium features not available in the free version

Who is it best for?

Retail investors that are looking for basic equities related data and want to use only the free version.

5. Tikr– best price-to-quality option for individual stock fundamentals data

Summary: TIKR is a financial data platform that provides access to comprehensive financial data for over 100,000 global stocks across 6 regions, 92 countries, and 136 exchanges. The platform caters to individual investors, professionals, and enthusiasts.

Pros:

- Intuitive and easy to platform

- Wall Street estimates

- Portfolio holdings of top funds and gurus

- Large universe of stocks with extensive historical data

- Offers free plan. Paid plans start at $14.95 per month

Cons:

- Screeners offer limited customizability

- Not possible to compare and benchmark a unique set of stocks

- Annual plans needed to get good pricing

Who is it best for?

Retail investors that are looking for extensive fundamentals historical data of individual stocks with the ability to choose from a very broad stock universe. Tikr is great for someone who wants to compare individual or a few stocks, but it does not offer the ability to compare against a broader or customizable benchmark.

6. Bloomberg– best for large professional trading & investing institutions

Summary: Bloomberg Terminal is a global financial research platform that offers an abundance of datapoints regarding financial markets. With over four decades of experience, it provides fast access to news, data, unique insights, and trading tools for leading decision-makers. Bloomberg is often considered as a gold-standard when it comes to financial & investing tools.

Pros:

- Industry leader in coverage of markets and securities across all asset classes

- Access to research from over 1,500 sources

- Proprietary Bloomberg research

- Sophisticated pre and post-trade analytics

Cons:

- High price, starting from $15,000 per year

- Steep learning curve

- Complex UI

Who is it best for?

Professional investors, hedge funds, banks and institutions.

7. Intrinio– best when looking to access or download large amounts of financial data

Summary: Intrinio is a real-time market data partner featuring seamless REST API integrations, scalable infrastructure, and high-quality data for all U.S. stocks, options, and over 100,000 globally traded securities.

Pros:

- Easy to use APIs for fundamentals data

- Access to +100,000 U.S. stock, options, ETF and other datapoints

- Accurate databases

Cons:

- High price, starting from $9,600 per year for fundamentals data

- No free option

- Requires some knowledge how to use API

Who is it best for?

Investors who are looking to get large amounts of financial data in a fast and automated way.

8. FactSet– a slightly cheaper alternative for professional investors to Bloomberg

Summary: FactSet is a comprehensive financial platform for investment professionals. FactSet integrates data from global financial markets, company fundamentals, estimates, and news sources into a single platform. The value it provides lies in its ability to offer real-time data, analytics, and customizable workflows.

Pros:

- All in one platform: data, analytics and tools in one place

- Can be integrated with other software systems

- Real time updates & instant market information

Cons:

- High price, starting from $12,000 per year

- Complex UI, can be overwhelming for beginners

- Steep learning curve

Who is it best for?

Institutional level investors who are looking for slightly cheaper alternative to Bloomberg.

9. Nasdaq Data Link

Summary: Nasdaq Data Link (formerly known as Quandl) is a data platform that provides access to a wide range of financial, economic, and alternative datasets. It offers institutional-grade data across various asset classes, including equities, commodities, currencies, and global economic indicators.

Pros:

- Institutional-grade data, reliable and high-quality available through API

- Allows selection of specific datasets and formats

- Can access large amounts of data with low latency

Cons:

- Freemium model very limited, price starts at $49 per month

- Requires some knowledge how to use API

- Relatively limited scope of data compared to other platforms

Who is it best for?

Investors who are looking to get large amounts of fundamentals data via an API.

10. Wisesheets– best for retail investors who like to have everything set up in Excel or Google sheets

Summary: Wisesheets is an Excel and Google Sheets add-on designed for investors and financial analysts to streamline the process of importing financial data into spreadsheets. It allows users to pull historical financials, stock data, and key metrics from thousands of global companies directly into their sheets.

Pros:

- Automated data import via Excel or Google Sheets plug-in

- Easy to use and user friendly

- Very accessible pricing, starting from $60 per year

Cons:

- Free version super limited

- Essentially no insights, just pull-in of raw data

- Very limited features outside of plug-in

Who is it best for?

An affordable tool for retail investors who are looking to do all of their analysis own their own within Excel or Google sheets.

11. Simply Wall St– best for retail investors who like to perform high-level quick analysis of individual stocks

Summary: Simply Wall St offers easy-to-understand financial data, analysis, and valuation models for companies, using infographics and charts to simplify complex financial metrics. Simply Wall St focuses on long-term investing by providing insights into company fundamentals, future growth potential, and risk analysis.

Pros:

- Uses infographics to simplify complex financial data

- Easy for beginners to navigate and understand

- Helps users track and manage their investments

Cons:

- Limited fundamentals data & ability to perform deeper analysis

- Limited ability of customizable screeners and models

- Plans start from $10, but only allows to view 30 stocks per month

Who is it best for?

Simply Wall St is an easy to use tool that uses infographics to pertain information in an easy to understand manner. It’s best for retail investors that want to do a quick high level analysis on an individual stock, and are not looking for deeper insights into a particular equity.

12. Financial Modelling Prep

Summary: Financial Modelling Prep is a platform that provides financial data and APIs for building and managing financial models. It offers a range of services including access to financial statements, stock market data, and valuation metrics for thousands of companies globally.

Pros:

- Provides financial statements, stock market data, and valuation metric

- Allows integration with financial models and applications

- Data for thousands of companies worldwide

Cons:

- Errors are not uncommon in data

- Customer support not very responsive

- Freemium model very limited, price starts at $29 per month

- Requires some knowledge how to use API

Who is it best for?

Investors who are looking to access large financial data sets via an API. Something to be aware of is that whilst Financial Modelling Prep is cheaper than other financial data API providers, it does have some errors in their data.

Summary – which tool is best for which purpose and type of investor?

- αlphaFinn – Best for fundamentals benchmarking & insights, not just plain financial data.

- Simply Wall St – best for retail investors who like to perform high-level quick analysis of individual stocks.

- Tikr – best price-to-quality option for individual stock fundamentals data.

- Wisesheets – best for retail investors who like to have everything set up in Excel or Google sheets.

- Finviz – best free option for very basic equities related data.

- Intrinio – best when looking to access or download large amounts of financial data.

- Factset – a slightly cheaper alternative for professional investors to Bloomberg.

- Bloomberg – considered as the “gold-standard” for large professional trading & investing institutions.

- Koyfin – closest alternative to Bloomberg for retail investors.