The 6 Best Macroeconomic Platforms

Discover & compare some of the best macroeconomic indicator data platforms that suit your needs.

There are several different platforms to choose from, each having their own set of unique levers, advantages and limitations.

We have analyzed a number of platforms in detail taking into account various features, advantages and limitations of the platforms, as well as pricing.

The below list represents a solid pool of websites the individual, boutique, family office and professional investors can choose from.

1. αlphaFinn – best for a combination of macro, fundamentals benchmarking & insights, not just plain data

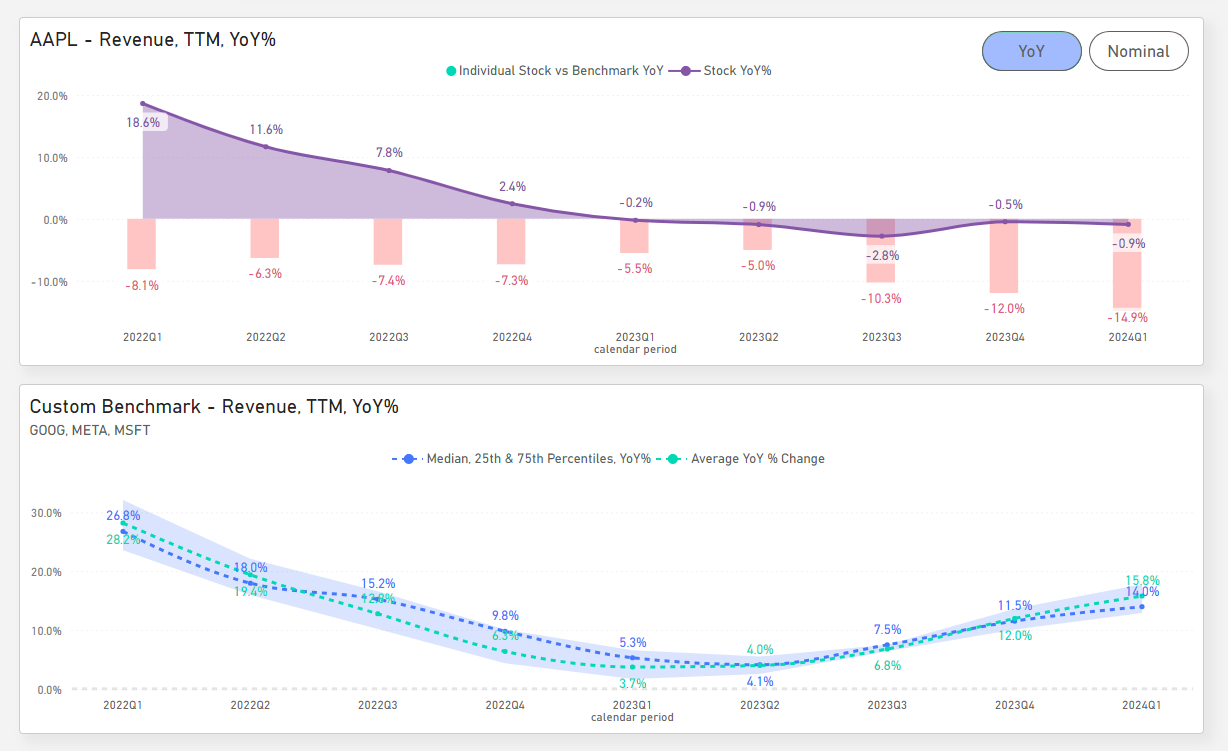

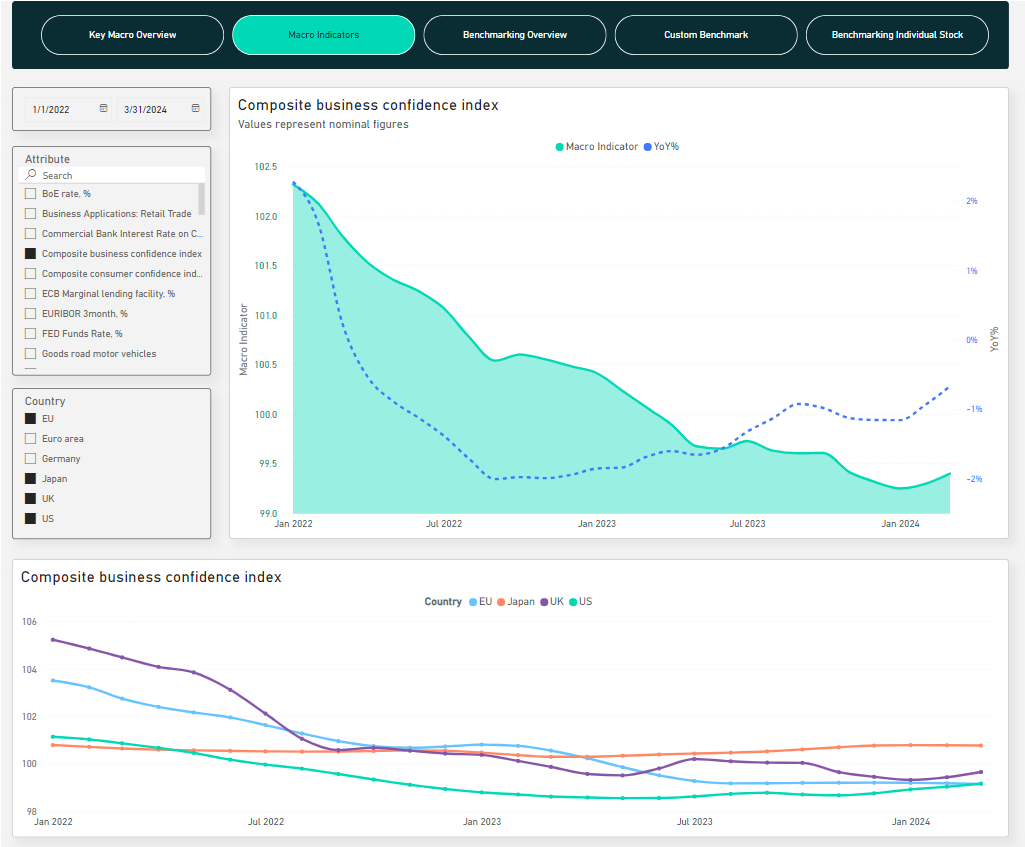

Summary: αlphaFinn offers a holistic view of financial fundamental data and macroeconomic indicators. It offers professional level insights such as benchmarking of individual stocks, sectors, broader indices and more, which can be overlayed with macroeconomic data to uncover trends and potential relationships. AlphaFinn also offers a customizable benchmark that investors can build themselves from the covered +5,000 stock universe.

It started of as a platform for professional investors, boutiques and family offices, now offering benchmarking insights, which no other platform offers, to retail investors.

Key Features:

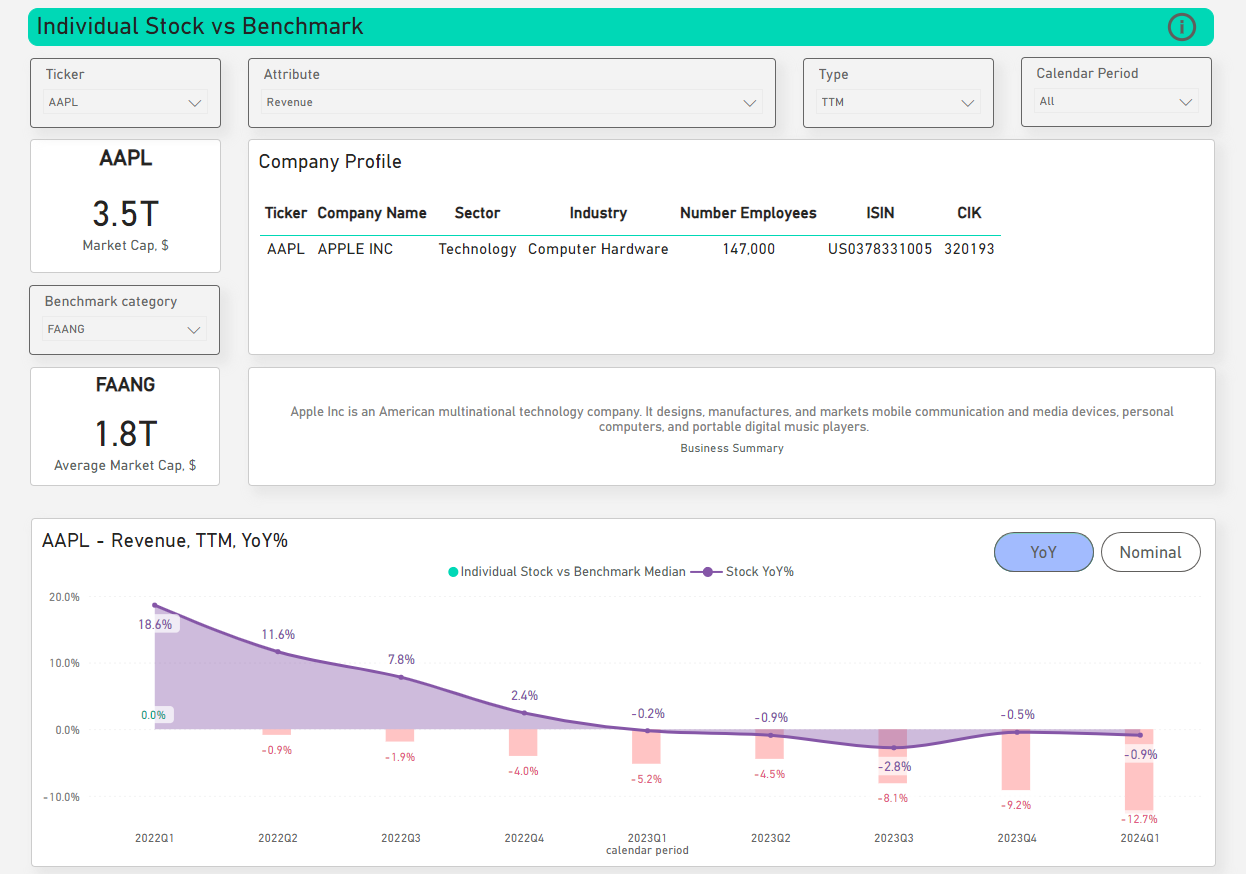

Benchmarking

This unique feature allows the user to compare a stock of choice against a broader benchmark (whether it’s S&P500, other indices, sectors, or a custom made benchmark) with the option to look at hundreds of metrics (growth, margins, ratios, etc.). With clear visuals the investor can identify in seconds whether the stock is over or underperforming against the benchmark of choice.

Data Visualization

AlphaFinn offers its users clear, informative and simple visuals that enables investors to identify how the stock is performing in a matter of seconds given their selected choice of parameters.

Macroeconomic indicators

AlphaFinn is one of the very few platforms that offers both fundamentals and macroeconomic data. Having a combination of such data gives an advantage to the investor, which can uncover broader trends, relationships and insights by overlaying and comparing financial and macro data.

Pros:

- Company Benchmarking (not offered by any other platform)

- Combination of Fundamentals & Macroeconomic Data

- +10 Years of Historical Data

- Offers 7 Day Free Trial

- Intuitive, Easy to Use Interface & Visuals

- Ability to Export Data To Excel or PDF

- Premium plans start at $13.5 a month

Cons:

- No mobile app (in the Roadmap and will be introduced in the near future!)

- Limited use case for day traders

Who is it best for?

Retail and professional investors who are looking for a combination of macro, fundamentals benchmarking & insights, not just raw data.

2. Macrobond– one of the most comprehensive macroeconomic platforms out in the market

Summary: Macrobond offers access to a vast array of global economic indicators and customizable analytics. The platform is designed to support economists, financial analysts, and researchers by providing advanced charting, forecasting, and data visualization tools. It is one of the most comprehensive macroeconomic data platforms out in the market.

Pros:

- One of the most comprehensive macroeconomic data platforms out in the market

- Customizable dashboards and reports

- Advanced analytics, offering sophisticated charting & forecasting

Cons:

- High price, starting for $15,000 – $20,000 per year

- There’s a learning curve to extract all the benefits from the platform

Who is it best for?

Macrobond is powerful and one of the most comprehensive macroeconomic indicator platforms available in the market. The platform is geared towards professional investments and institutions as the platform is relatively complex and the pricing start from $15,000.

3. YCharts

Summary: YCharts is a comprehensive and versatile financial data platform, offering a wide range of tools for stock and fund research, economic data analysis, and market insights. It has plans for individual investors, professional advisors, and large firms.

Pros:

- Various financial data and research tools

- Customizable dashboards and reports

- Index and mutual fund data

Cons:

- No public pricing

- Targeted more towards professionals, enterprise level pricing

- Steep learning curve

Who is it best for?

YCharts is targeted more towards professional investors. The platform is not as intuitive and does require some time to learn how to use it, although it can be used by individual investors as well.

4. TradingView– best for traders who are looking to incorporate macroeconomic indicators into their analysis

Summary: TradingView is a popular online platform offering advanced charting tools, real-time market data, and social networking features for traders and investors. It provides a wide range of technical analysis tools, customizable charts, and access to global financial markets, including stocks, forex, cryptocurrencies, and commodities.

Pros:

- User friendly interface

- Robust tools for technical analysis, key macro indicators & customizable charts

- Offers a free plan with basic access, limited features and ads

- Affordable pricing, starting from $14.95 per month

Cons:

- Relatively limited macro indicators compared to other competitors

- Some real-time data may come with additional costs

- Most of the premium features accessible only in the priced plans

Who is it best for?

TradingView is targeted more towards retail traders, and to some extent investors. It’s a good and affordable option for the retail trader looking to incorporate macroeconomic data into their thesis and trades.

5. TradingEconomics– best for investors who want to compare various economic indicators across a number of different countries

Summary: TradingEconomics is one of the most popular economics and macro platforms out in the market. It offers over 20 million data points across 196 different countries.

Pros:

- Comprehensive database of macro indicators across 196 countries

- Easy-to-navigate interface with accessible data visualizations.

- Free data available, although very limited

Cons:

- On the pricier side, starting from $199 per month

- Quality of data can vary as some users have reported inconsistencies

- Charting and data visualization tools relatively basic and less sophisticated

Who is it best for?

TradingEconomics is used by both retail and professional investors, offering an extensive database of macro indicators. It’s a good alternative for investors with a slightly larger budget who are looking to compare economic data across a number of different countries.

6. Investing.com– best for retail investors looking for an adequate amount of economic data via a free version

Summary: Investing.com is a comprehensive financial platform that offers a wide range of tools and information for traders and investors. The platform offers features such as news, analysis, technical charts, and economic calendars.

Pros:

- Comprehensive tools, offering technical charts, economic calendars, and financial news

- Offers a number of macro indicators for free

- User friendly interface

- Affordable pricing, starting from $12.99 per month

Cons:

- Can be overwhelming due to the large amount of information and features.

- Limited advanced analytical tools compared to premium platforms

- Quality of data can vary as some users have reported inconsistencies

Who is it best for?

Investing.com is used by both retail and professional investors. It’s a great option for retail investors who are looking for a platform that offers a wide range of economic data at no cost, with fairly friendly user interface.

Summary – which platform is best for which purpose and type of investor?

αlphaFinn – best for a combination of macro, fundamentals benchmarking & insights, not just plain data.

Macrobond – one of the most comprehensive macroeconomic platforms out in the market, targeted for professional investors.

TradingView – best for traders who are looking to incorporate macroeconomic indicators into their analysis.

TradingEconomics – best for investors who want to compare various economic indicators across a number of different countries.

Investing.com – best for retail investors looking for an adequate amount of economic data via a free version.